Experts in U.S. Tax

U.S. expat taxes for Americans living in the Netherlands and abroad. As expats ourselves, we have been where you are, we understand.

You’ve got tax questions, we’ve got solutions.

Personal Tax Preparation

Let us file your annual Form 1040 or get caught up on prior years. We can file for the foreign earned income exclusion, or apply foreign tax credits. We also file your state tax returns.

Business Tax preparation

Our clients have business interests in sole propietorships, LLC’s, S Corps and Corporations. We file all the necessary annual tax returns and reports. Are you a shareholder in a foreign corporations? Our experts can handle that too.

FINCEN Reporting (FBAR)

A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year.

Additional Services

US Expat Tax & Accounting Consultations

We stay up-to-date on all the regulatory and legislative developments so you don’t waste time and energy trying to make sense of all the tax complexities. Need to make a tax plan for the upcoming year? Our consultants can help!

Streamline Filing Procedures

Have you been living abroad and recently learned you need to file your U.S. taxes? Now is a great time to get caught up through the Streamline Filing Procedures. The IRS is offering amnesty and an opportunity for penalty abatement for those who didn’t know they needed to file. Start today – the IRS reserves the right to end the programs at any time and has indicated that the program will not continue indefinitely.

Accidental Americans

Were you born abroad, or do you have dual citizenship and just found out about your U.S. tax filing requirement? Getting caught up can be easier than you think. We can provide a consultation to determine the best way forward. Often, this requires filing six years of FATCA reporting and three years of tax returns. We offer a complete package to bring you into compliance. Don’t let your American passport hold you back!

The process

Four simple steps to complete your U.S. tax filing:

Step 1

Get a free consultation

Step 2

Complete the tax package

Step 3

Submit your documents

Step 4

Review, sign and done!

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Years in Business

Tax returns filed

Countries serviced

Our Story

BNC Tax & Accounting B.V. is the leading U.S. expat tax firm for Americans living in the Netherlands. Founded by expats for expats, our team of Enrolled Agents and CPAs has been helping U.S. taxpayers abroad navigate the complexities of international tax compliance since 2002.

We understand the expat experience because we live it every day. Whether you moved abroad for love, opportunity, or you're managing a cross-border business, we’ve helped thousands of clients avoid penalties, reduce stress, and reclaim their time.

Headquartered in the Netherlands, we specialize in clear, personalized tax and accounting solutions for Americans overseas. Our approach grows with you whether you're staying for a few years or building a life abroad.

At BNC, we’re focused on building long-term relationships and smarter tax strategies that adapt as your life evolves.

You didn’t move abroad to worry about taxes. Let BNC handle the hard part so you can focus on what brought you here.

Contact Us

The Netherlands

Keizersgracht 62, 1015 CS Amsterdam

+31 20 520 6815

Mexico

Amapas 124, Col. Emiliano Zapata, Puerto Vallarta, Jal. 48380

+52 (322) 223-5862

U.S.A.

225 Cabrillo Hwy S. Suite D, Half Moon Bay, CA 94019

+1 (650) 242-8162

Partners

Dutch tax filings: Orange Tax Services

Mexican tax filings: Equilibrium

Bonaire tax filings: Stephens Tax & Administration

Blog

Resources & Articles To Help You Stay On Top Of Your Taxes

U.S. Citizens Moving to Bonaire: Smart Tax Planning & Structuring – Part 1

Thinking about trading your office view for turquoise waters? If ending your workday with your toes in the sand sounds appealing, you’re not alone. Bonaire’s warm climate, relaxed pace of life, and incredible natural beauty make it an increasingly popular choice for...

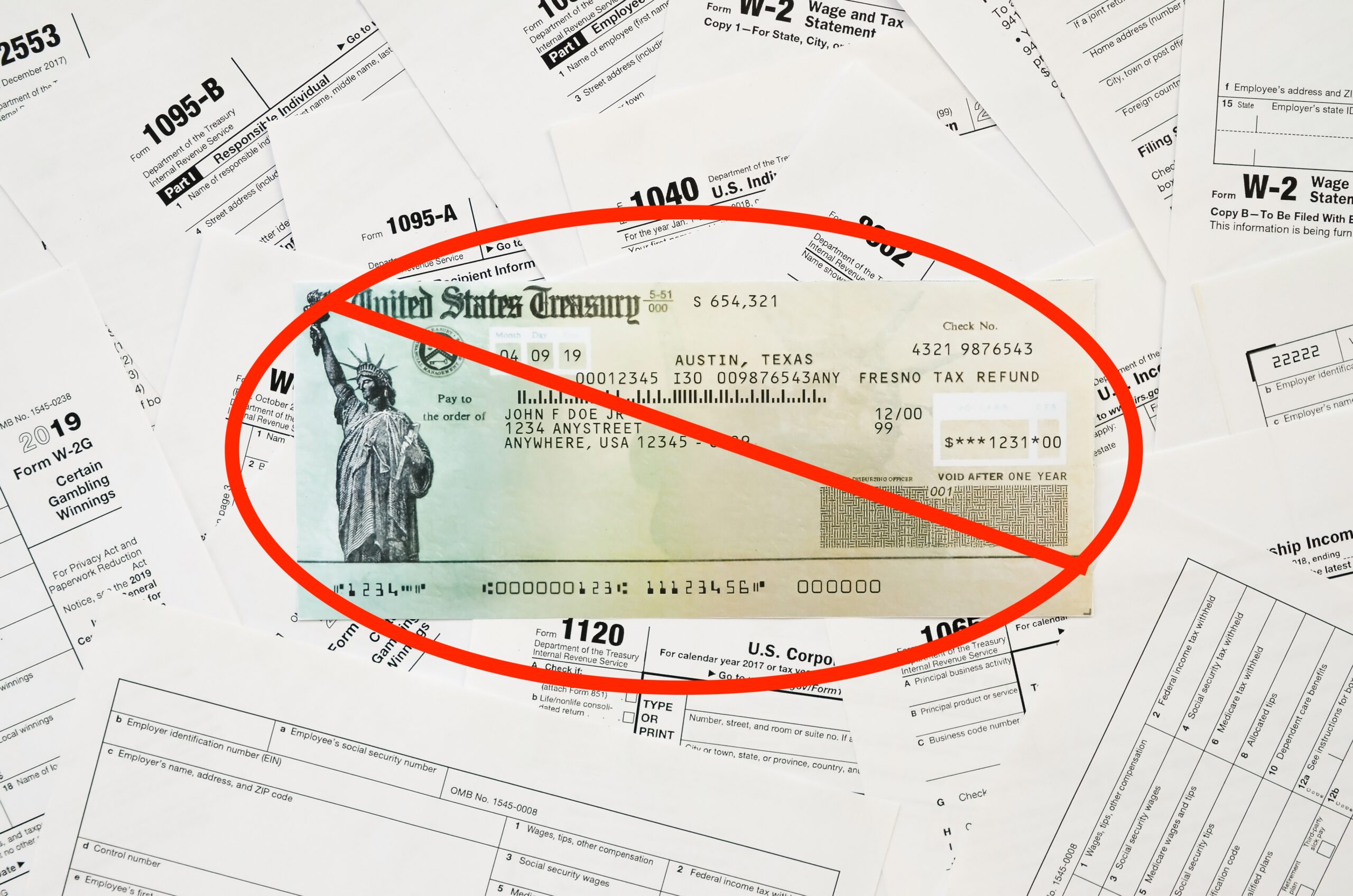

IRS to Discontinue Paper Checks After September 30, 2025

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025 We want to inform you of an important change announced by the Internal Revenue Service (IRS) regarding the issuance of tax refunds and other payments. Effective September 30, 2025, the...

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens What You Need to Know After the One Big Beautiful Bill Act (OBBBA) If you are a U.S. citizen married to a nonresident alien (NRA) and your spouse owns...