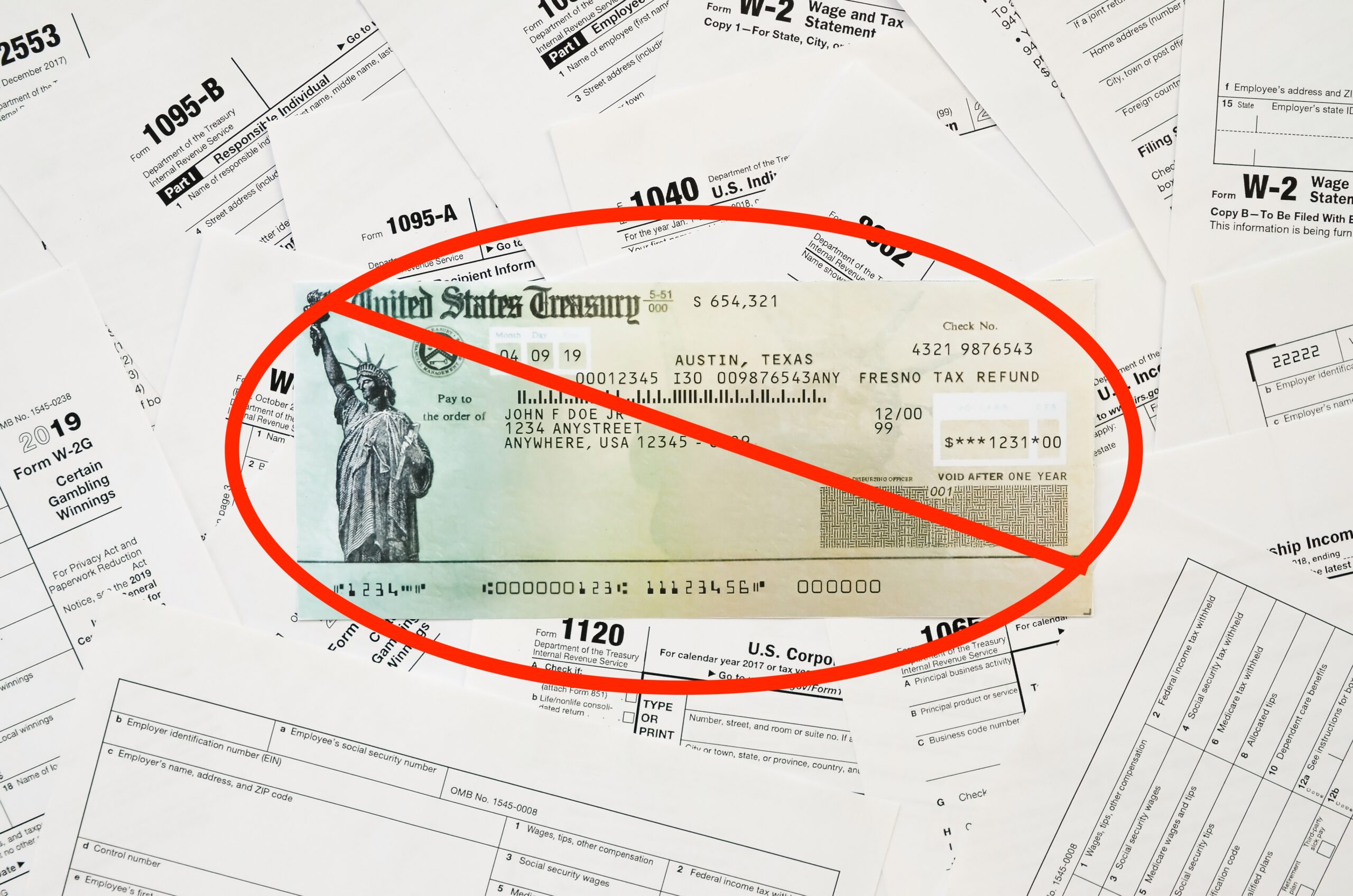

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025

We want to inform you of an important change announced by the Internal Revenue Service (IRS) regarding the issuance of tax refunds and other payments.

Effective September 30, 2025, the IRS will no longer issue paper checks for refunds or other disbursements. All payments from the IRS will be made electronically, either by direct deposit to your bank account or through other approved electronic payment methods.

What Does Discontinued Checks Means for You?:

- If you are expecting a refund or any payment from the IRS after September 30, 2025, you must ensure that your direct deposit information is up to date with the IRS.

- If you do not currently have a bank account or access to electronic payment options, we strongly encourage you to make arrangements as soon as possible (this is likely to be when we e-file your next tax return) to avoid delays in receiving future payments.

- This change is part of the IRS’s ongoing efforts to improve efficiency, reduce fraud, and provide faster, more secure payments to taxpayers.

What are Action Steps for IRS Direct Deposits?:

- If you are working directly with the IRS payment systems, review your current direct deposit information on file with the IRS.

- Log into your account on www.irs.gov and review

- If you are working with BNC tax and need to update your banking information, you can do so when filing your next tax return or by using the IRS’s online tools.

- If you have any questions or need assistance setting up electronic payment options, please contact our office. We are here to help you navigate this transition smoothly.

We will continue to monitor IRS updates and provide you with the latest information. Thank you for your attention to this important change.