U.S. Tax Updates and Information

Find below the latest articles on all items related to your (expat) taxes. Enjoy reading!

Tax Return Filing Deadlines for U.S. Citizens Living in the Netherlands

For U.S. citizens residing in the Netherlands, tax return filing comes with dual responsibilities. It means understanding the rules for both the U.S. and Dutch...

U.S. Citizens Moving to Bonaire: Smart Tax Planning & Structuring – Part 1

Thinking about trading your office view for turquoise waters? If ending your workday with your toes in the sand sounds appealing, you’re not alone. Bonaire’s warm climate,...

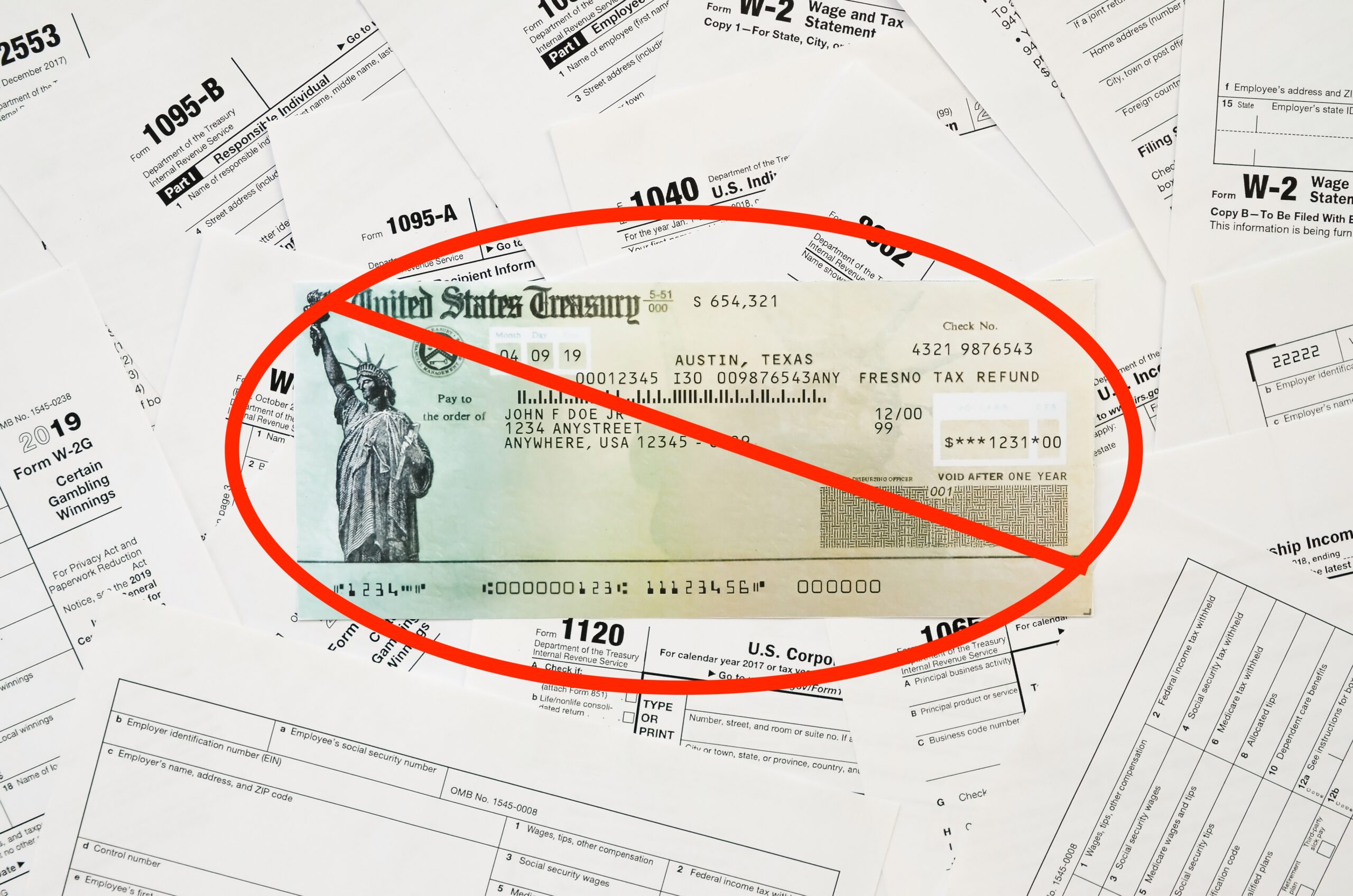

IRS to Discontinue Paper Checks After September 30, 2025

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025 We want to inform you of an important change announced by the Internal Revenue Service...

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens What You Need to Know After the One Big Beautiful Bill Act...

What Are the Exact Steps to Open a Trump Account for Your Baby Born Abroad?

The Trump Account is also for U.S. expats with U.S. citizen children! If you’re a U.S. citizen living overseas and just welcomed a new baby, a new government funded account...

U.S. Taxpayer Married a Non-Resident Alien – 5471 (2017-2025)

U.S. Taxpayer Married a Nonresident Alien? You Might Need to Report Their Foreign Corporation to the IRS on Form 5471! Congratulations! Getting married is full of love,...

How the ‘One Big Beautiful Bill’ Impacts U.S. Expats and Foreign-Connected Taxpayers

The 119th Congress has passed what’s been coined the “One Big Beautiful Bill Act” or OBBBA (more formally known as H.R. 1), enacting a sweeping set of reforms that reshape...

Dutch-American Friendship Treaty (DAFT)

The Dutch-American Friendship Treaty (DAFT) is a special agreement between the U.S. and The Netherlands. It offers a straightforward path to residency and self-employment in...

Should You Register as a ZZP or BV as an American Entrepreneur in the Netherlands?

Should You Register as a ZZP or BV as an American Entrepreneur in the Netherlands? When Americans move to the Netherlands under the Dutch-American Friendship Treaty (DAFT)...

BE-10 Frequently Asked Questions (FAQ)

VIDEO REVIEW: BNC Tax Explains the BE-10 Form Requirements Do You Need to File the BE-10? A Complete Guide for Expats and Small Business Owners (2025) The BE-10 form is a...

Mother-Daughter Legacy: Paper Ledgers to Global Virtual Firm

At BNC Tax & Accounting, Mother’s Day Isn’t Just a Holiday—It’s Our Origin Story Long before Christie became CEO of BNC, she was a little girl sorting paper checks in...

Myths and Truths About 2024 Tax Filing

It is halfway through February 2025 and the rumor mill when it comes to U.S. taxes is churning faster than ever this year. So we're here to bust two of the biggest myths...

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Contact Us

The Netherlands

Keizersgracht 62, 1015 CS Amsterdam

+31 20 520 6815

Mexico

Amapas 124, Col. Emiliano Zapata, Puerto Vallarta, Jal. 48380

+52 (322) 223-5862

U.S.A.

225 Cabrillo Hwy S. Suite D, Half Moon Bay, CA 94019

+1 (650) 242-8162

Partners

Dutch tax filings: Orange Tax Services

Mexican tax filings: Equilibrium

Bonaire tax filings: Stephens Tax & Administration