Janelle Moore, LICSW

Janelle brings over five years of expertise in helping U.S. citizens navigate the complex interplay between Dutch and IRS tax systems. Specializing in DAFT-related tax solutions and the 30% ruling, she’s your go-to expert for understanding the nuances of expat tax planning.

Janelle’s straightforward philosophy? Compliance is key. When she’s not diving into tax intricacies, you might catch her writing long emails (a personal specialty) or simply ensuring her clients feel confident and informed. Need help with the Dutch-U.S. tax maze?

Janelle is here to simplify it for you.

Tax Question?

Office Address

Keizersgracht 62

1015 CS Amsterdam

Netherlands

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Latest BNC Insights on US Taxation

U.S. Citizens Moving to Bonaire: Smart Tax Planning & Structuring – Part 1

Thinking about trading your office view for turquoise waters? If ending your workday with your toes in the sand sounds appealing, you’re not alone. Bonaire’s warm climate, relaxed pace of life, and incredible natural beauty make it an increasingly popular choice for...

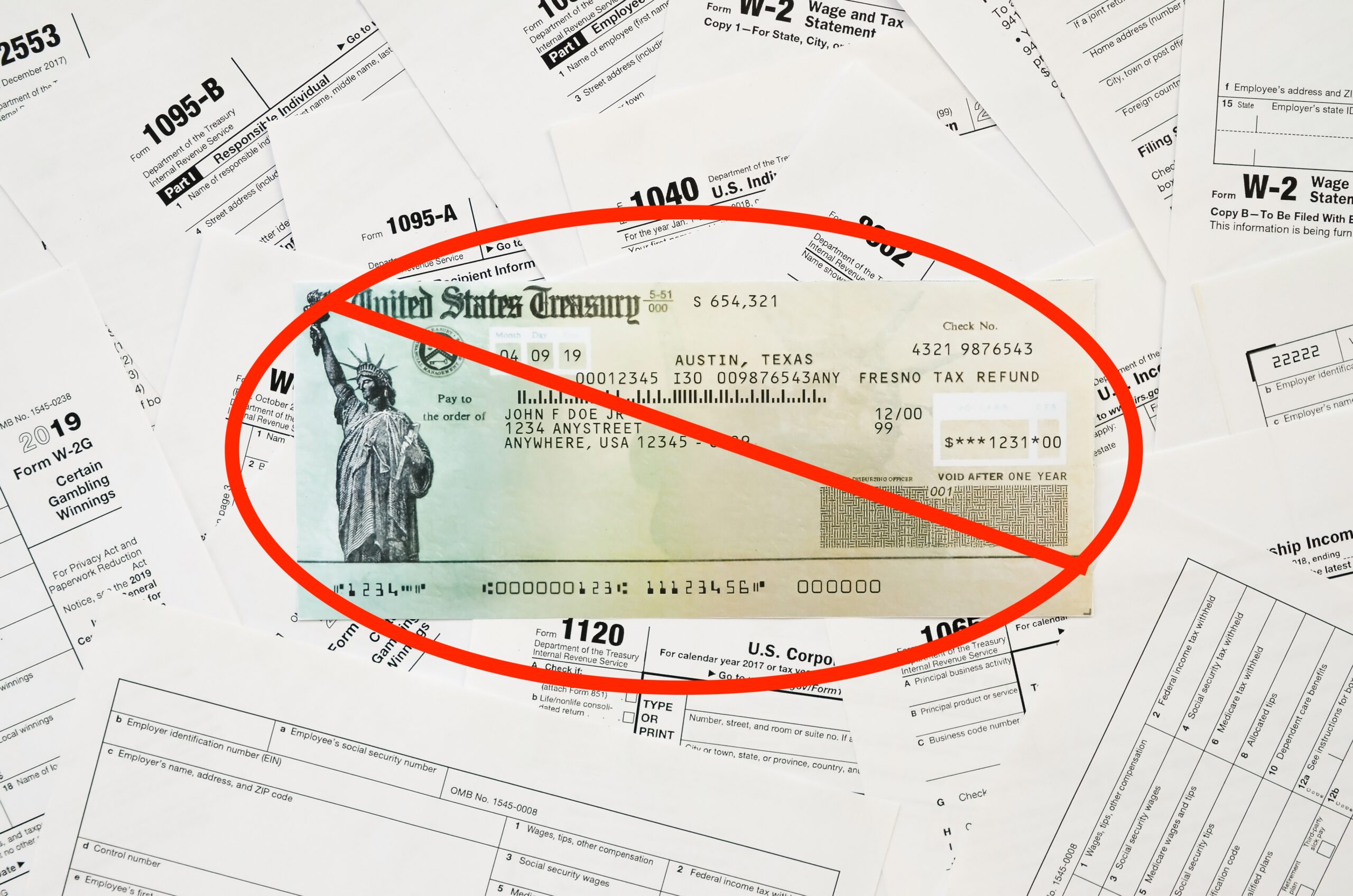

IRS to Discontinue Paper Checks After September 30, 2025

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025 We want to inform you of an important change announced by the Internal Revenue Service (IRS) regarding the issuance of tax refunds and other payments. Effective September 30, 2025, the...

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens What You Need to Know After the One Big Beautiful Bill Act (OBBBA) If you are a U.S. citizen married to a nonresident alien (NRA) and your spouse owns...