Kristina Thomas

Kristina Thomas is a dedicated tax preparer at BNC Tax & Accounting, bringing five years of experience to the team. With a background in broadcast journalism, she excels in simplifying complex tax concepts for expats and small business owners. Kristina is currently pursuing her Enrolled Agent certification to further enhance her expertise.

Beyond her professional endeavors, she is an avid creator, engaging in art, video games, and various creative projects. Kristina’s unique blend of communication skills and tax knowledge makes her a relatable and effective advisor for clients navigating the intricacies of tax compliance.

Tax Question?

Office Address

Keizersgracht 62

1015 CS Amsterdam

Netherlands

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Latest BNC Insights on US Taxation

U.S. Citizens Moving to Bonaire: Smart Tax Planning & Structuring – Part 1

Thinking about trading your office view for turquoise waters? If ending your workday with your toes in the sand sounds appealing, you’re not alone. Bonaire’s warm climate, relaxed pace of life, and incredible natural beauty make it an increasingly popular choice for...

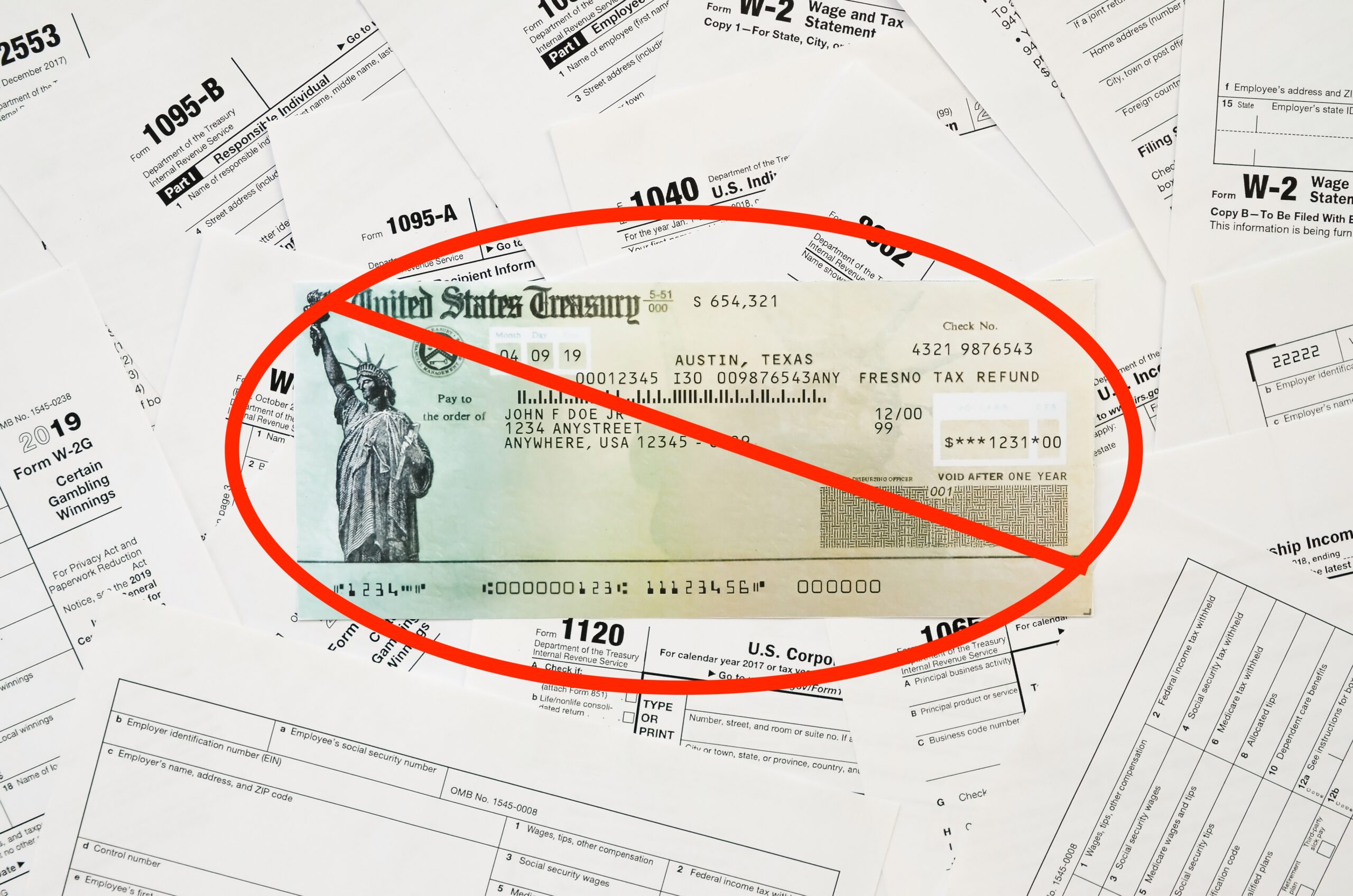

IRS to Discontinue Paper Checks After September 30, 2025

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025 We want to inform you of an important change announced by the Internal Revenue Service (IRS) regarding the issuance of tax refunds and other payments. Effective September 30, 2025, the...

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens What You Need to Know After the One Big Beautiful Bill Act (OBBBA) If you are a U.S. citizen married to a nonresident alien (NRA) and your spouse owns...