Scott Grandfield, EA, NTPI Fellow

Scott has been helping U.S. taxpayers with taxes since 1989. In 2009, he started his own tax practice and ran it successfully until 2021. Also, noteworthy, his firm won the Anaheim Chamber of Commerce – Family Business of the Year. In 2020, Scott moved to the Netherlands and now focuses on assisting Americans living abroad with their U.S. tax responsibilities.

He specializes in U.S. tax and trust returns, making complex tax rules easier to understand for Americans in the Netherlands. Whether you need help with personal taxes or business tax planning, Scott offers support tailored to your needs.

Scott is knowledgeable in international tax laws, including foreign income reporting, FBAR and FATCA compliance, and the latest IRS rules for expats. He understands the unique challenges of living abroad and aims to optimize your tax situation for the best results.

With over a decade of experience running his own practice, Scott knows the concerns of both individuals and businesses. He provides personalized, careful, and reliable services, staying updated on tax developments to ensure accurate solutions.

Join Scott to navigate U.S. taxes for Americans abroad. He is committed to protecting your financial interests and meeting your tax obligations, so you can focus on what matters most. Contact him today to start this tax journey together!

Tax Question?

Office Address

Keizersgracht 62

1015 CS Amsterdam

Netherlands

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Latest BNC Insights on US Taxation

U.S. Citizens Moving to Bonaire: Smart Tax Planning & Structuring – Part 1

Thinking about trading your office view for turquoise waters? If ending your workday with your toes in the sand sounds appealing, you’re not alone. Bonaire’s warm climate, relaxed pace of life, and incredible natural beauty make it an increasingly popular choice for...

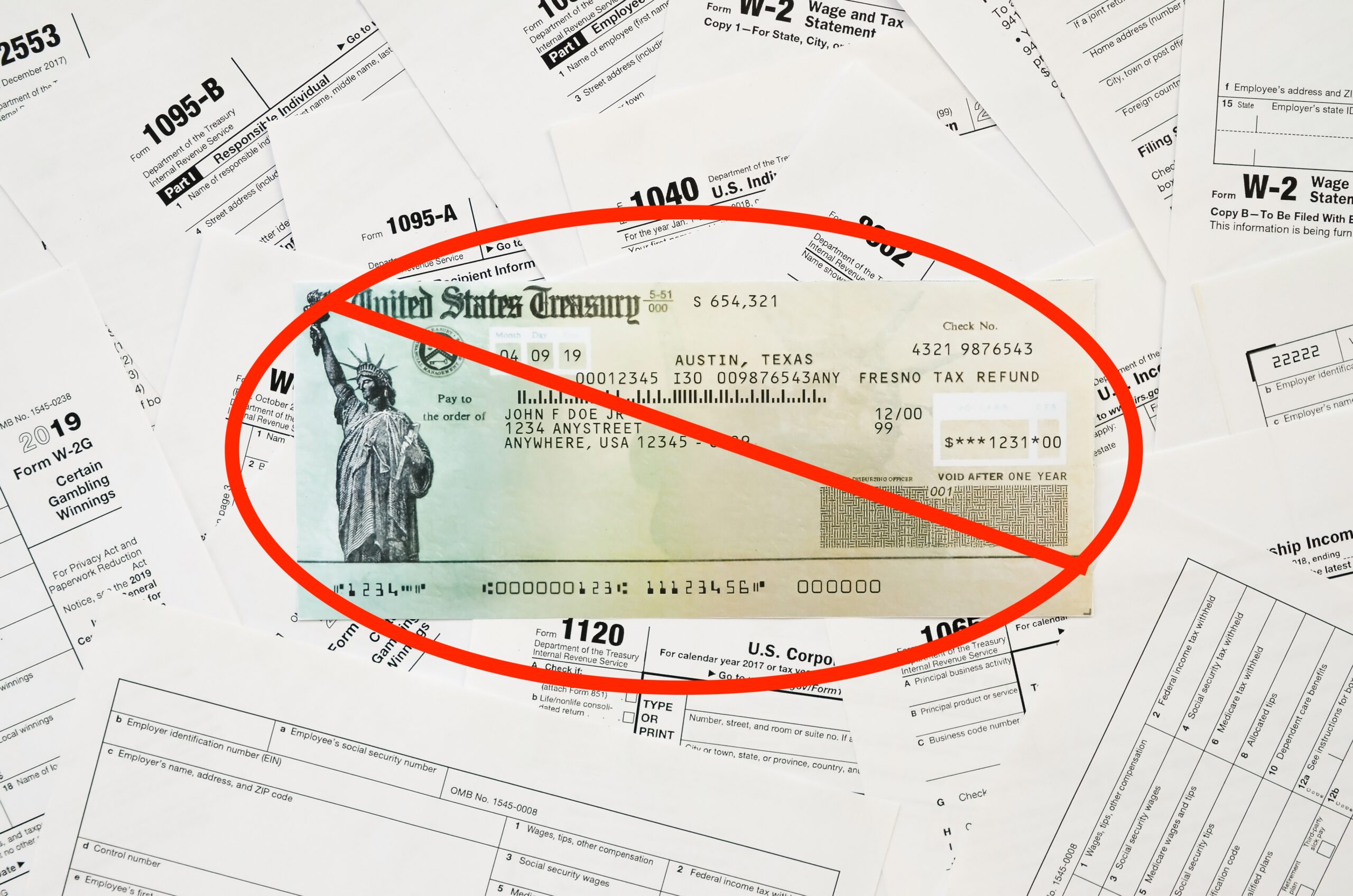

IRS to Discontinue Paper Checks After September 30, 2025

Important Announcement: IRS to Discontinue Paper Checks After September 30, 2025 We want to inform you of an important change announced by the Internal Revenue Service (IRS) regarding the issuance of tax refunds and other payments. Effective September 30, 2025, the...

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens

How the Downward Attribution Rules Changed for Form 5471 for U.S. Citizens Married to Nonresident Aliens What You Need to Know After the One Big Beautiful Bill Act (OBBBA) If you are a U.S. citizen married to a nonresident alien (NRA) and your spouse owns...