Scott Grandfield, EA, NTPI Fellow

Scott has been helping U.S. taxpayers with taxes since 1989. In 2009, he started his own tax practice and ran it successfully until 2021. Also, noteworthy, his firm won the Anaheim Chamber of Commerce – Family Business of the Year. In 2020, Scott moved to the Netherlands and now focuses on assisting Americans living abroad with their U.S. tax responsibilities.

He specializes in U.S. tax and trust returns, making complex tax rules easier to understand for Americans in the Netherlands. Whether you need help with personal taxes or business tax planning, Scott offers support tailored to your needs.

Scott is knowledgeable in international tax laws, including foreign income reporting, FBAR and FATCA compliance, and the latest IRS rules for expats. He understands the unique challenges of living abroad and aims to optimize your tax situation for the best results.

With over a decade of experience running his own practice, Scott knows the concerns of both individuals and businesses. He provides personalized, careful, and reliable services, staying updated on tax developments to ensure accurate solutions.

Join Scott to navigate U.S. taxes for Americans abroad. He is committed to protecting your financial interests and meeting your tax obligations, so you can focus on what matters most. Contact him today to start this tax journey together!

Tax Question?

Office Address

Keizersgracht 62

1015 CS Amsterdam

Netherlands

Discover Expert Tax Solutions

Unlock the potential of your life abroad with a personalized US tax consultation.

Latest BNC Insights on US Taxation

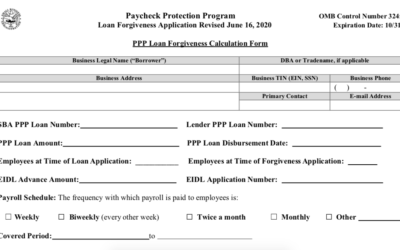

Self Employment Compensation Clarification for PPP Loans

The Small Business Association (SBA) has published new guidance about PPP Loan Forgiveness. We have been waiting and watching for guidance and the SBA has slowly been releasing information and regulations. Last week on August 4, the SBA posted a new downloadable PDF...

PPP Loan Forgiveness – How to Apply

Have you received a Paycheck Protection Program (PPP) loan, or are you planning to apply for one? Read on to learn more about PPP loans and how to apply for PPP loan forgiveness. NOTE: There is still time to apply for a PPP loan! The deadline to apply has been...

New Tax Deduction for Charitable Donations in 2020

Taxpayers who do not itemize their deductions can claim as much as $300 in charitable contributions for calendar year 2020, thanks to a temporary change to the tax code. Typically, taxpayers who itemize their deductions on Schedule A of Form 1040 can deduct donations...