Updated: Feb 14 2024

New Beneficial Ownership Reporting (BOI) Rules

As part of the Corporate Transparency Act, The Department of the Treasury Financial Crimes Enforcement Network (FinCEN) has introduced rules requiring certain entities to report information about their beneficial owners. This is not a tax form and does not cause any tax liability. This is the same agency which presides over FBAR reporting.

Who Needs to Report, or, a “Reporting Company”

The reporting requirements apply to most corporations, limited liability companies (LLCs), and other entities created in or registered to do business in the U.S. A “beneficial owner” is defined as any individual who, directly or indirectly, owns 25% or more of the equity interests of the entity or exercises substantial control over the entity. The aim is to enhance transparency and combat financial crimes.

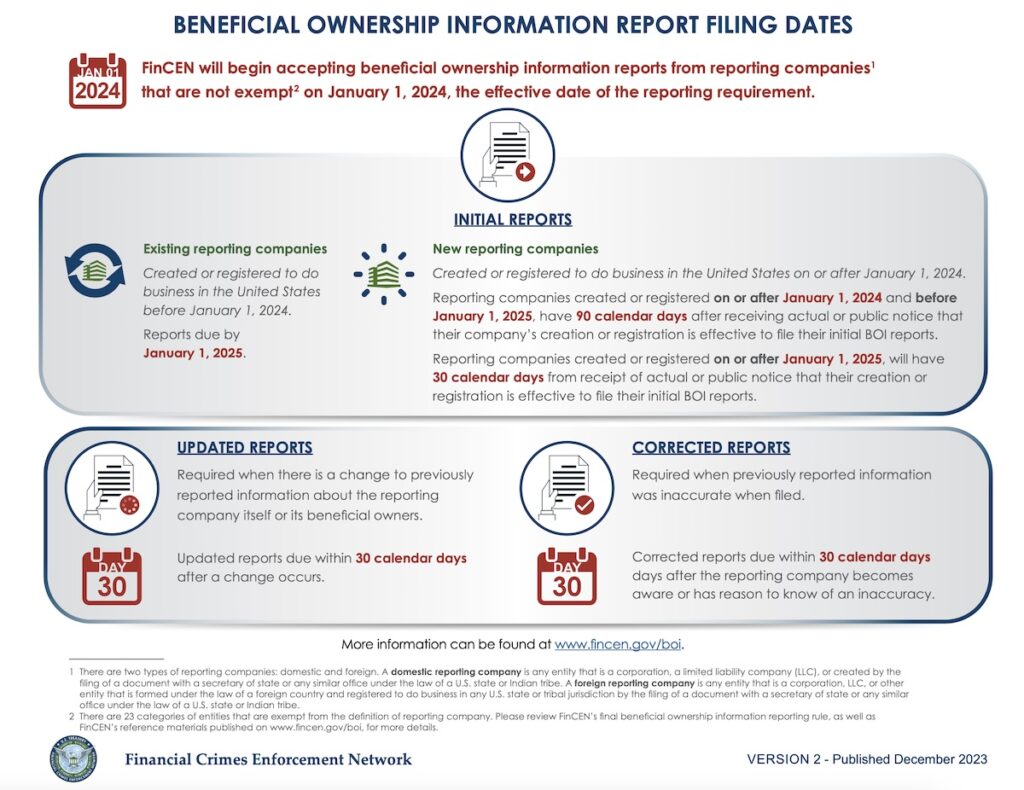

Key Due Dates:

Reporting companies created or registered before January 1, 2024, will have until January 1, 2025, to file their initial BOI reports with FinCEN.

Reporting companies created or registered between January 1, 2024 and December 31, 2025, will have 90 calendar days to file their initial BOI reports with FinCEN.

Reporting companies created or registered on or after January 1, 2025, will have 30 calendar days to file their initial BOI reports with FinCEN.

Foreign Businesses Exemption:

Most importantly for some of our clients, foreign businesses that are not registered to do business in the U.S. have no reporting requirement under these new rules. This distinction is crucial for international businesses concerned about the scope of these regulations and their applicability to their operations.

Penalties:

Failure to comply or file on time will incur penalties of $591per day up to $10,000.

Frequently Asked Questions have been published to the FinCEN site.

Examples:

U.S. citizen owner of a sole proprietorship in The Netherlands which is not registered to do business in the U.S. does not qualify as a reporting company and is not required to file a BOI report.

U.S. citizen owner of an LLC registered in California, with the owner residing in Portugal, does qualify as a reporting company and have a required to file a BOI report.

U.S. based partnership registered in Delaware with multiple foreign partners does qualify as a reporting company and have a required to file a BOI report.

BNC Tax does not offer business reporting services including reports we may have filed in the past. If your entity is registered to do business in the United States, you need to manage your entity’s reporting requirements.

Our Recommendation:

To navigate these new rules efficiently and ensure ongoing compliance with all your business reporting requirements, we highly recommend utilizing an entity management service. Services such as those by https://www.eminutes.com specialize in managing Beneficial Ownership Information (BOI) reporting, state by state annual reporting, annual corporate minutes, and keeping your company in good legal standing. Their expertise can simplify the process, reduce the administrative burden on your team, and help avoid potential non-compliance penalties.

While the Department of the Treasury and IRS continue to add complexity to the filing requirements of average Americans, those for Americans abroad become even more complex. BNC Tax specializing in tax advisory for expats. Get in touch to learn how we can help.