U.S. taxpayers can access their tax information online by creating an account on IRS.gov.

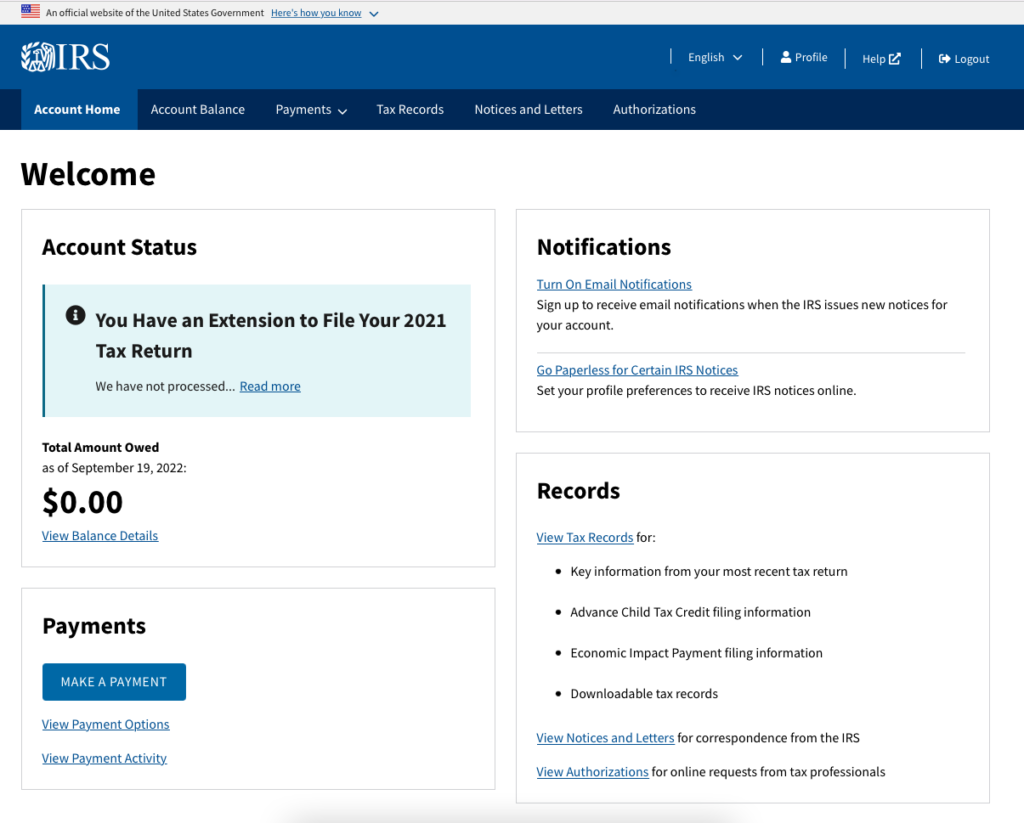

You already have online accounts for most things that you buy and services that you use, including your banks, credit cards, cell phone, electric bill, car payments, software subscriptions and many other things. Those online accounts are the repository of your bills due and payments made, as well as lots of other information. The IRS site is no different. You can see your taxes owed, payments made, and lots of other information, such as:

- Adjusted gross income. You or your tax preparer may need to enter your AGI from a previous year into the tax preparation software to validate your identity.

- Economic Impact Payments. Also known as “stimulus checks.” The IRS has a record of all Economic Impact Payments that were sent out, and you can see yours in your personal account.

- Estimated tax payments. You can see all of the estimated tax payments that you made during the year, as well as refunds applied as credits.

- Payment plans. View the details of your payment plan or request a payment plan.

- Digital communication. View digital copies of select notices from the IRS.

- Digital signature. You can digitally sign certain authorization forms, such as a power of attorney, initiated by your tax professional through the IRS portal.

How to Set Up Your IRS Account

Here are the steps to set up your account at IRS.gov.

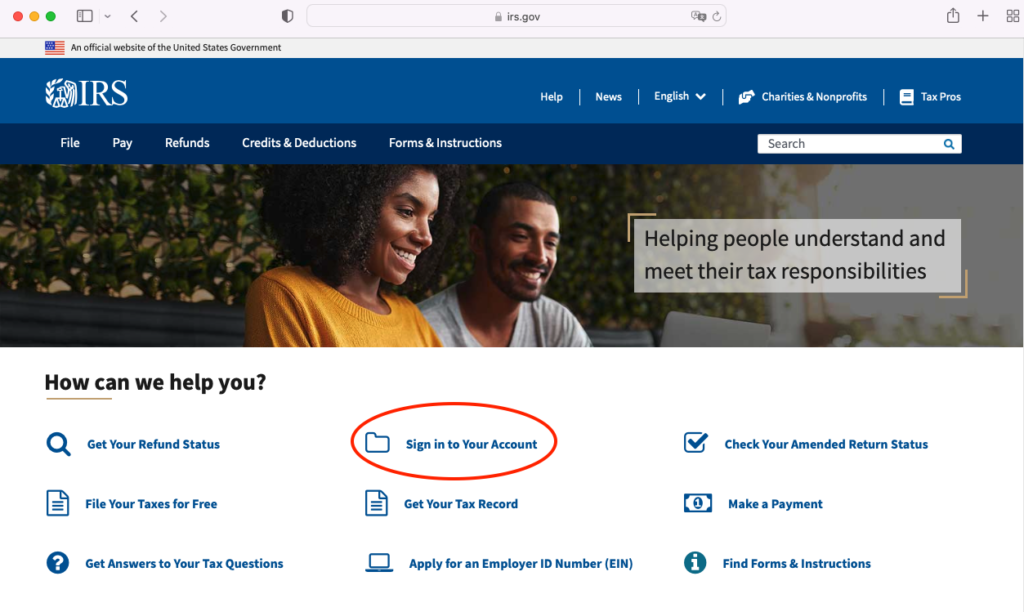

1. Go to IRS.gov and click “Sign in to Your Account.”

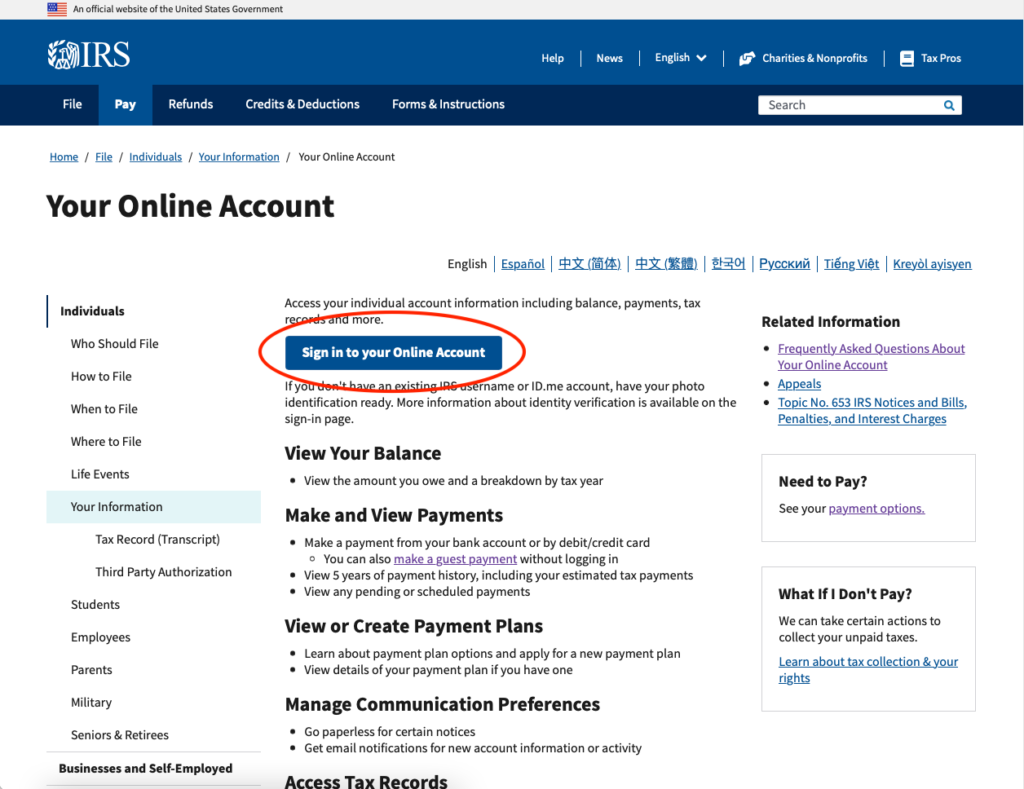

2. On the next page, click the “Sign in to your Online Account” button.

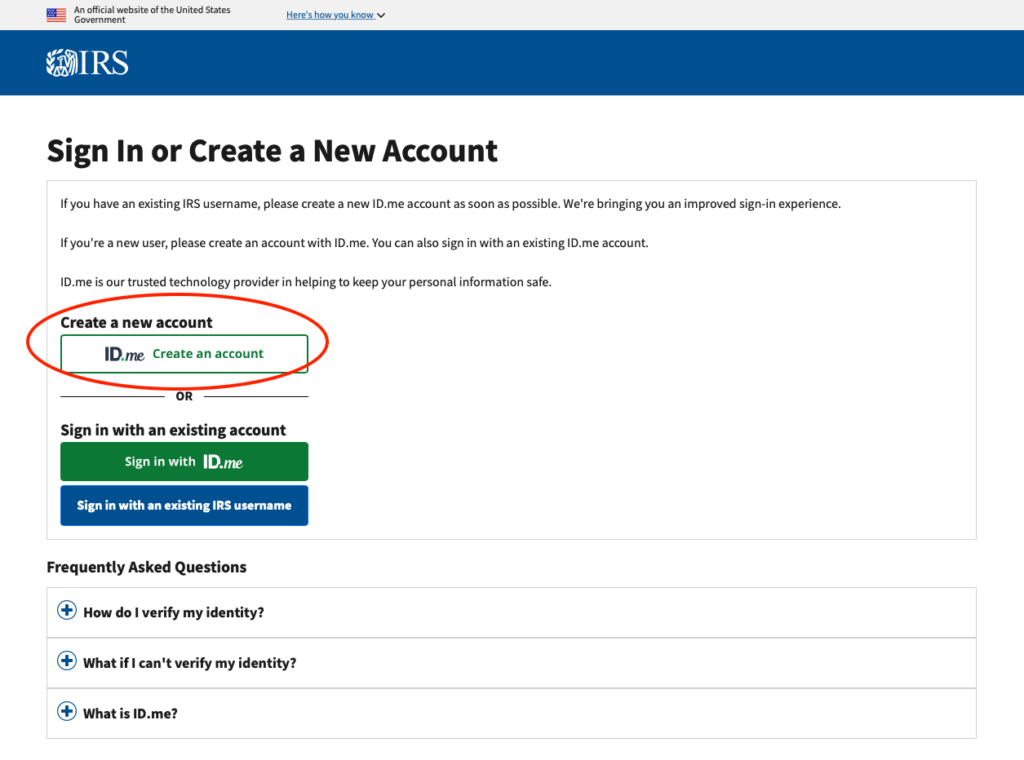

3. Click “Create a new account” with ID.me

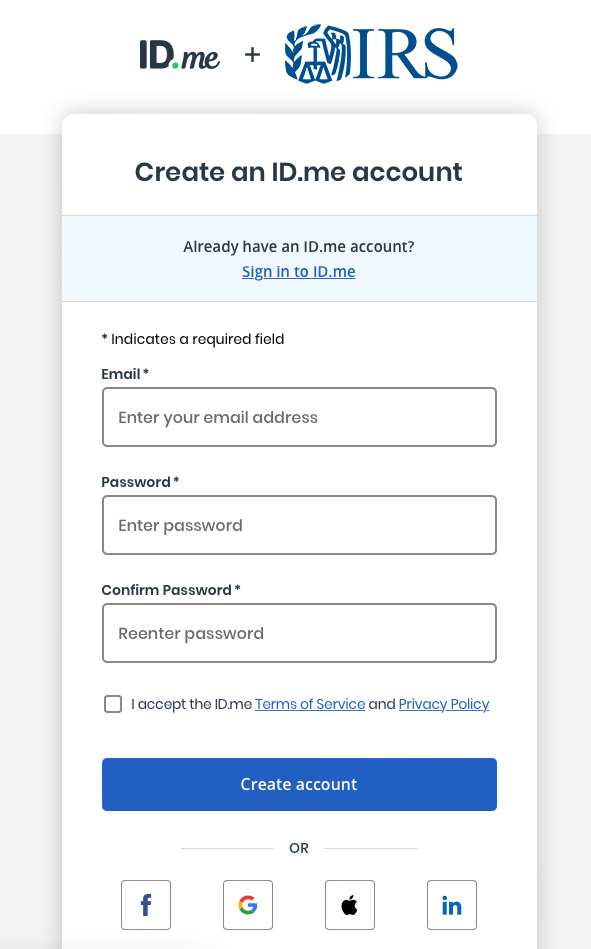

4. Create a username and password, or use the option to sign in through Google, Facebook, Apple, or LinkedIn.

If you don’t have a U.S. phone number

ID.me requires a U.S. phone number to verify users. If you don’t have a U.S. phone number, you will need to do two workarounds.

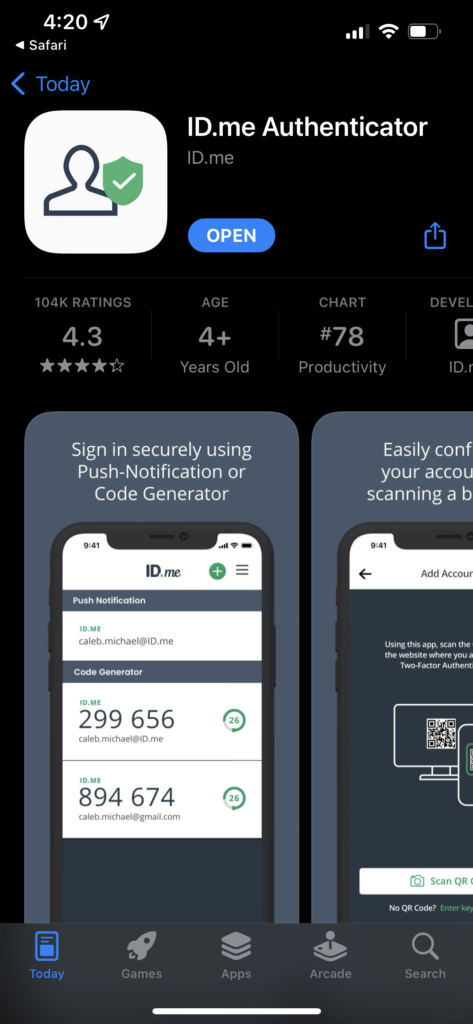

1. Download the ID.me Authenticator app

This app allows you to verify your sign-in attempt via push notifications to your phone, as opposed to receiving a code to a U.S. phone number. This is for multi-factor authentication every time you sign into your IRS account through ID.me.

2. Video interview with an ID.me agent

If you have a U.S. phone number, you can receive a link from ID.me that invites you to upload your driver’s license and a video selfie. However, if you don’t have a U.S. phone number, you can’t receive that link from ID.me. The workaround is to schedule a video call with an agent.

First, you will need to upload photos of your U.S. driver’s license, passport, a selfie photo, and a statement from your U.S. bank or financial institution. (Uploading just the first page is ok. They’re looking for address verification, not scrutinizing your banking transactions.) Once an agent from ID.me has verified your documents, they will email you to set up an interview via video call. The video call only takes a few minutes. You will hold up your driver’s license and passport to the camera so the agent can verify your identity.

Signing up is worth it!

Even though it’s a bit of a pain to set up your IRS account through ID.me, it’s worth it. In the end, you can see your tax return records, payment records, taxes due, and lots of other information from past years that you may need to file your taxes for the current year. We encourage all of our clients to create an account with the IRS and log in there to check your own records.