On March 27, the president signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to financially bolster Americans through the COVID-19 pandemic.

The stimulus package includes Economic Impact Payments of up to $1,200 to Americans who qualify (also known as stimulus checks).

In April, the IRS started direct-depositing funds into taxpayers’ bank accounts, and sending checks and debit cards in the mail.

Most people have received the payment by now, but if you haven’t, read on to find out what your next steps should be.

In particular, Americans living abroad might not have received payments yet. We recommend you follow the steps below, as well.

What To Do If I Haven’t Received My Stimulus Check

If you filed your 2019 tax return before stimulus payments started going out, then you should have received a direct deposit to the bank account you indicated on your return.

If you had not filed your 2019 tax return before stimulus payments started going out, you may be expecting to receive a check or a debit card in the mail. Follow these steps to find out when you should expect to receive it.

1. Check the IRS “EIPFAQ” Website

If you have not yet received a stimulus payment, the very first thing you should do is consult the IRS “Economic Impact Payment” Frequently Asked Questions (EIPFAQ) website. Search this page and get answers to all of your questions about the stimulus payment, especially if you are a non-filer or have some other atypical tax filing status.

2. Check the IRS “Get My Payment” Website

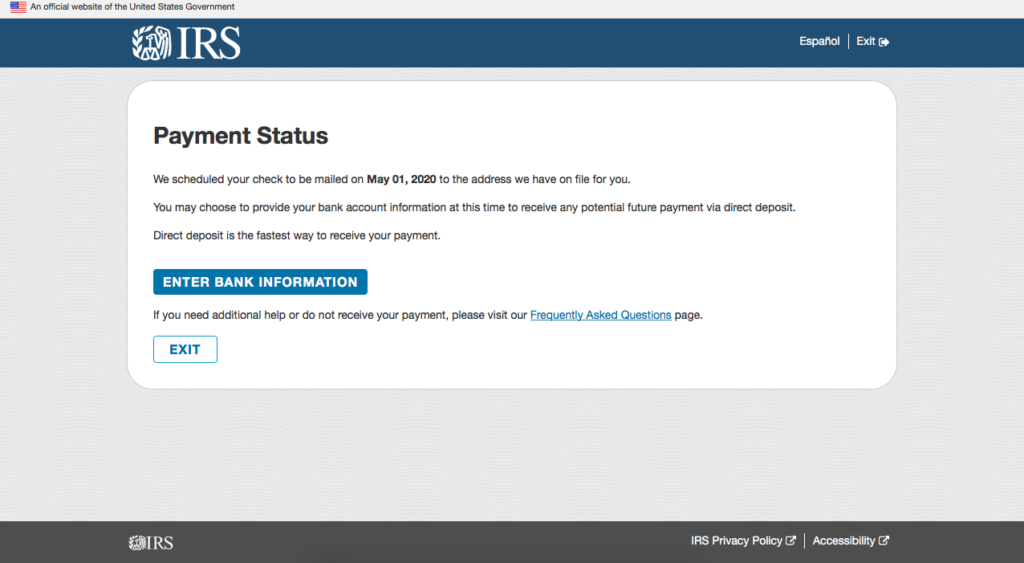

Next, check the IRS Get My Payment website. This site will tell you if funds have been deposited into your account or if your check has already been mailed. Click the “Get My Payment” button and enter your information exactly as it appears on your tax return.

If your Payment Status indicates that you should be receiving a check, it may actually arrive as a debit card. On their website, the IRS states that debit cards come in a plain envelope from “Money Network Cardholder Services.” For more information, see the IRS website about Prepaid Debit Cards.

In August, 2020, the IRS added a new field to this page where you can add your Direct Deposit information.

3. Call the IRS Coronavirus (COVID-19) Telephone Assistance Line

The IRS has set up a special phone line for questions about Economic Impact Payments (stimulus checks) with approximately 3,500 phone representatives. The phone number to call is 800-919-9835. This is a triage line. Tell the phone agent that you did not receive your stimulus check and you need to request a payment trace. The phone agent will funnel you to an IRS agent.

Even with the large number of representatives available, the IRS warns on their website that live phone assistance is extremely limited at this time. If you can’t get through, try calling back later. Have your personal information ready when you call, including your social security number or tax ID number, address, date of birth, tax filing status (single, head of household, married and filing joint tax return, or married filing separate tax return), and the details of your tax return from the last year you filed (2019 or 2018).

You can also start the payment trace process by mail. Fill out IRS Form 3911, Taxpayer Statement Regarding Refund (PDF). Write “EIP” on the top of the form. The top section of this form is for IRS use. You only need to fill out Sections I, II, and III. Answer all the questions as they relate to your stimulus payment.

For box Number 7 under Section I, check the box that says “individual” and enter “2020” as the tax period. Leave the date you filed your taxes blank.

Print, sign and mail the form to the IRS center where you would normally file a paper tax return (the address that corresponds to your state of residence).

If your state of residence is Alabama, Florida, Georgia, the Carolinas, or Virginia, send the form to the Department of the Treasury, Internal Revenue Service Center, Atlanta GA 3991-0002.

If your state of residence is Kentucky, Louisiana, Mississippi, Tennessee, Texas, or if you are an international resident, send the form to the Department of the Treasury, Internal Revenue Service Center, Austin TX 73301-0002.

If your state of residence is District of Columbia, Maine, Maryland, Massachusetts, New Hampshire, or Vermont, send the form to the Department of the Treasury, Internal Revenue Service Center, Andover MA 05501-0002.

If your state of residence is Arkansas, Connecticut, Delaware, Indiana, Michigan, Missouri, New Jersey, New York, Ohio, Pennsylvania, Rhode Island, or West Virginia, send the form to the Department of the Treasury, Internal Revenue Service Center, Kansas City MO 64999-0002.

If you live in any other state, send the form to the Department of the Treasury, Internal Revenue Service Center, Fresno CA 93888-0002.

Taxpayers living abroad please note: You must wait at least 9 weeks from the date the check was mailed to begin a payment trace. Once you initiate the payment trace by phone or by mailing form 3911, you’ll need to wait 6 weeks to see if you receive the check. After 6 weeks, if you still have not received the check, the IRS can confirm that it has not been cashed. You have to call again to confirm it wasn’t cashed, and request a new check. If the check was cashed, you will need to file a fraud claim.

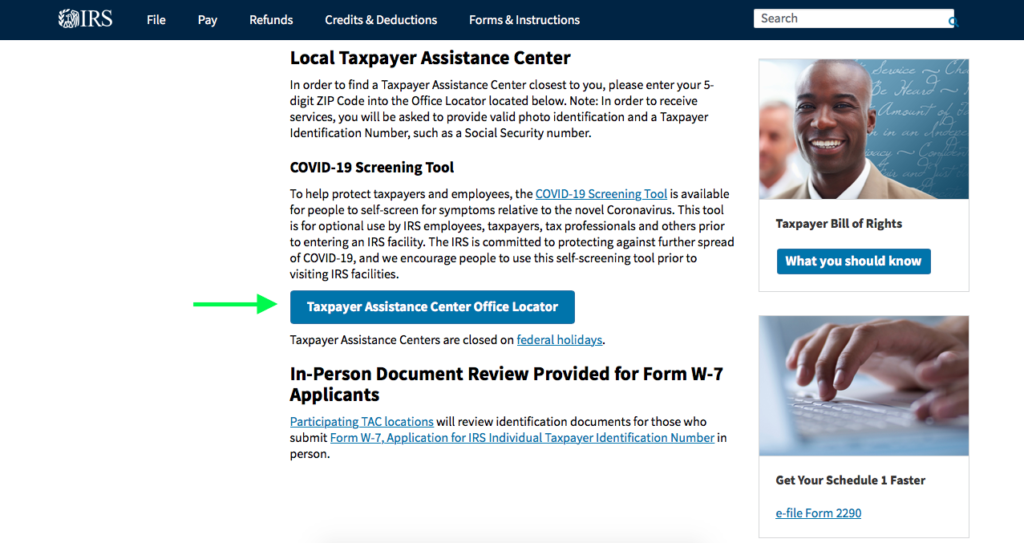

4. Visit a Taxpayer Assistance Center, or Send a Letter

If you still can’t find the information you need about your stimulus payment, it may be possible to meet with an IRS representative in person at a Taxpayer Assistance Center (TAC). There are 27 TACs in the U.S. There is not one in every state, but you can check the online directory to find the closest TAC to you. Click the “Taxpayer Assistance Center Office Locator” button and enter your zipcode to get a listing of offices near you. Some of the TACs are closed at this time, while others are open by appointment only, so you’ll need to call to find out if they are open. If you don’t mind waiting longer for an answer, you can also send a letter to the TAC. Their addresses are listed in the directory.

Will I Owe Taxes on My Stimulus Check?

No, the stimulus check is not taxable income. According to the IRS, taxpayers will not owe tax on that money. The payment will not reduce your refund or increase the amount you owe when you file your 2020 tax return next year.

If you need help with tax planning for 2020 and beyond, schedule an appointment with BNC Tax to discuss your personal situation and create a plan.