by Corie DuChateau | Mar 29, 2022 | Blog, Expat, FBAR

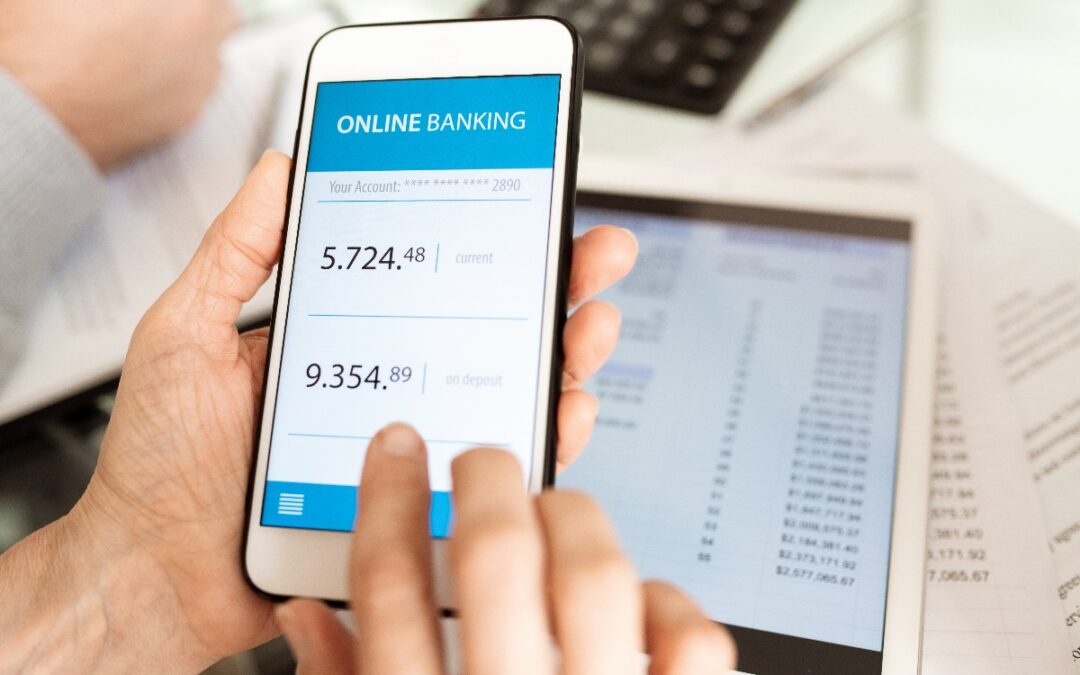

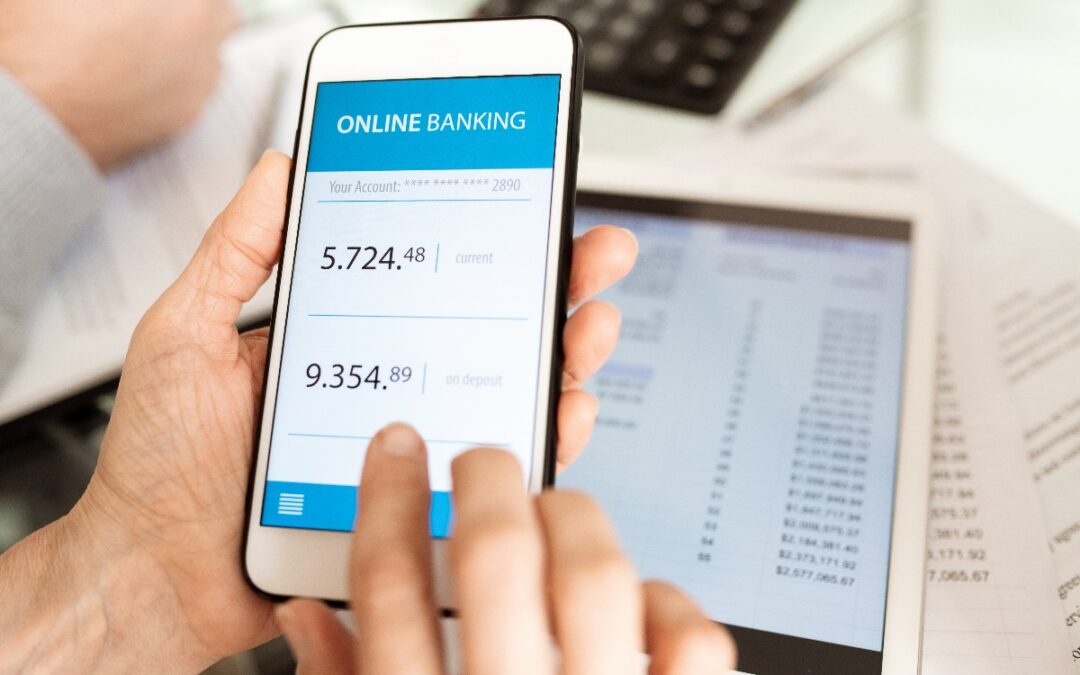

All U.S. citizens are required to file an annual FBAR for all qualifying foreign bank and financial accounts Many Americans living overseas are required to file a Foreign Bank Account Report (FBAR). The FBAR is filed separately from your tax return with the Department...

by Corie DuChateau | Sep 1, 2021 | Blog, Expat, FBAR

If you are a U.S. citizen living abroad, you may have heard about the FBAR, and you may be wondering what it is and whether or not you need to file one with your taxes. What Is the FBAR? The FBAR is a United States Department of the Treasury form that stands for...

by Corie DuChateau | Sep 1, 2021 | Blog, Expat, FBAR

This post is a follow-up to our previous blog post – How to Do Your Own Taxes – about the forms you need to file when living abroad. That post outlined the typical forms that working expats need to file when they have a simple return, for example, if you...

by Corie DuChateau | Apr 13, 2021 | Blog, FBAR, Tax Updates

Even though the tax filing deadline has been extended to May 17 this year, the FBAR is still due on April 15. That’s because the FBAR is handled by the US Treasury Department while the rest of your tax return is handled by the IRS. These are two separate...

by Corie DuChateau | Feb 15, 2021 | Blog, Expat, FBAR

It’s tax season again, and if you are an American citizen living abroad, you may be wondering how to do your own taxes now that you live in a foreign country. For example, you might need to report your foreign bank accounts or claim a credit for your foreign income....